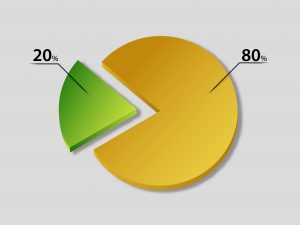

Vilfredo Pareto, an Italian economist, civil engineer, and socialist, in 1906 made the observation that within Italy 80% of real estate was owned by 20% of the population. Pareto discovered that this phenomena expanded beyond Italy’s borders occurring in neighboring countries as well. In later years this research by Pareto was used by Joseph Juran and applied to quality control within other industries. Juran dubbed the phenomena the Pareto Principle.

According to Wikipedia, in one of Pareto’s books, published in 1909, Pareto discusses this distribution of wealth and how it transitions time, society, and borders. Pareto stumbled upon this phenomena. He was studying property ownership in Italy and discovered the effect. He then applied his observations to the distribution of wealth in human society.

Pareto and Juran

It was later in 1941 when Joseph Juran, a Romanian engineer and management consultant, discovered Pareto’s observations and applied them to quality control and coined the Pareto Principle. Juran referred to the premises as the “vital few and trivial many.” Juran surmised if he could erase 20% of the poor quality control causes in a business that it would eliminate 80% of the problems. His theory proved correct.

Juran’s observations that Pareto’s concept which surmised that the amount of input wasn’t directly related to the amount of output was important. It allowed the concept to be applied to many different industries or situations. It also showed the importance of focusing on the most important aspects of input or cause.

Pareto’s concepts are incredibly powerful if you use them correctly. Keep in mind the concept doesn’t necessarily subscribe to perfect boundaries of 20% and 80%. The boundaries are grey lines that can vary plus or minus in either direction, but the concept holds relatively accurate in many situations.

From a business perspective this principle can be applied in many areas to improve the outcome or performance of an organization or product. For example, if you’re in sales and marketing you will find that at the end of each year your sales can often be broken up using Pareto’s theory where around 80% of your sales will come from close to 20% or your clients.

If your business growth plateaus the fastest way to grow a business or get it off of a plateau is to focus on the top 20% of customers for future growth rather than cultivating new customers as the priority. It works, and often the best new customers can come as a referral from your top 20%.

Pareto’s concepts apply to investing. Within investing you’ll find that generally the majority of your profitable output comes from far less of your investments annually. Within equity investing the principle holds true a lot of the time if you hold more than one position. The percentages may not hold exactly true to the 80/20 principles for various factors, but they are usually close.

To give you an example of how closely this can play out, take the QQQ’s etf from 2019 to 2020. The QQQ’s etf is considered an index etf and seeks to mirror the non-financial Nasdaq-100 index. The QQQ’s 2020 annual report shows a net asset appreciation of the QQQ etf of 60.6 billion dollars for the year. The top twenty asset gainers of the QQQ’s holdings accounted for approximately 78% of the gains.

For long term investing Pareto’s Principle can work as a strong concept for portfolio management. As an example if you’re holding a long term gainer, and the story is firing on all cylinders, and you’re profitable there may be a good opportunity to add to your holdings to further enhance the long term output. Profit can create larger profits when managed properly.

Choose GWA for your investing. Contact us here.